Smarter Loan Intake

Built for Mortgage Brokers

LoanPigeon™ streamlines loan intake — collecting documents, detecting missing items, organizing submissions, and preparing clean loan packets before they enter your loan origination or management system.

Not a loan origination system — a faster, easier way to handle intake.

Everything you need to modernize loan intake

Tools that help mortgage brokers collect documents, organize submissions, and prepare clean loan packets—before they enter your LOS or lender systems.

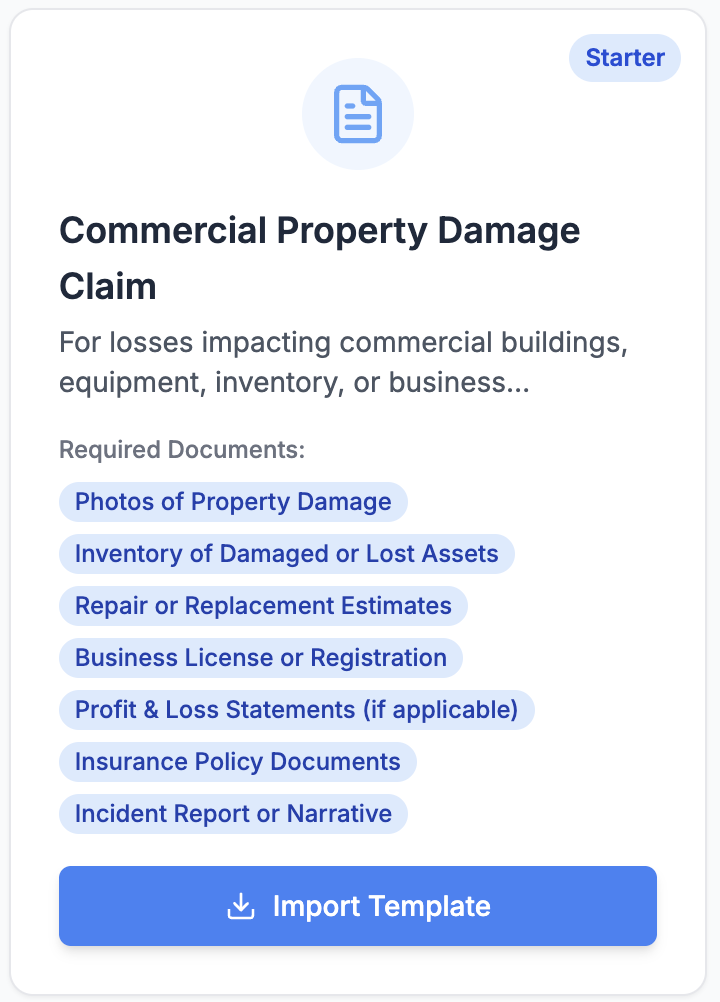

Guided Document Collection

Borrowers upload required documents through simple, secure portals with clear instructions and real-time progress updates. Missing items are automatically flagged.

Organized Loan Workspaces

Each loan is automatically organized with required document lists, file previews, activity history, and completion indicators—everything your team needs in one clean, easy-to-use interface.

Automated Workflows

Trigger actions when files arrive, when information is missing, or when a submission reaches key milestones. Assign team members, send reminders, tag documents, and more—automatically.

Trusted by Mortgage Brokers

Brokers use LoanPigeon to eliminate intake chaos and start loans with complete, structured submissions.

"For the first time, we're not drowning in missing documents. LoanPigeon has transformed how quickly we can move loans forward."

"Before LoanPigeon, our staff spent hours tracking down documents. Now borrowers upload everything effortlessly and workflows run automatically."

"The automation tools help us stay on top of missing documents. We spend less time chasing borrowers and more time moving loans forward."

Compliance & Security You Can Trust

Mortgage brokers rely on LoanPigeon to handle sensitive borrower documents during intake. Our platform is built with strict protections to keep your information private, secure, and fully under your control. Brokers remain responsible for loan handling and compliance.

Strong Encryption

All documents and information are encrypted while in transit and while stored, using modern security standards to ensure client data remains protected at all times.

Secure Team Permissions

Your brokerage controls who can view loans, upload documents, or manage settings. Only authorized team members can access sensitive information.

Full Activity Tracking

Every important action—uploads, downloads, updates, and workflow events—is recorded with timestamps for complete visibility and compliance reporting.

Reliable Cloud Infrastructure

LoanPigeon runs on secure, redundant cloud systems with automatic backups, encryption, and continuous monitoring to ensure maximum uptime and protection.

Private Agency Data

Your agency’s documents and claim information are kept fully separate from other organizations. No one outside your team can ever view or access your data.

Designed for Safety

Every part of LoanPigeon follows strict "minimum access" principles, meaning systems and team members only receive the access they absolutely need—nothing more.

Ready to modernize your loan intake process?

LoanPigeon is currently onboarding brokerages in a guided way. Join mortgage brokers that are starting loans with complete, structured intake.